What Is Car Insurance?

A car insurance is the policy which covers your car against financial losses that you may face in case of accident or theft of car. You pay a certain amount as a premium to the insurance company to buy this cover, and they agree to pay for accidental damages and theft losses. As per IRDA (Insurance Regulatory and Development Authority), it is mandatory for any vehicle running on Indian roads to be covered under an active car insurance policy.

Based on the type of policy and add-ons that you opt for, your car insurance policy may include:

- Liability Cover

- Invoice Cover

- Engine Protector

- Tyre Cover

- Electrical Accessories

- PA For Unnamed Passenger

- Consumable Cover

- 24*7 Roadside Assistance

- No Claim Bonus

- Key & Lock Replacement

- Non-Electrical Accessories

- LL To Paid Driver

How Car Insurance Works

Car insurance is given to you based on various factors like the brand and model of your car, what kind of driver are you, and your past car insurance history. You may opt only for a third party cover

The comprehensive policy is a package

of different types of features (add-ons) like liability cover, accident cover, invoice cover, consumable cover, engine cover etc. All these are discussed in a separate section on our website.

The comprehensive policy is a package

of different types of features (add-ons) like liability cover, accident cover, invoice cover, consumable cover, engine cover etc. All these are discussed in a separate section on our website.

Please note, while buying a car insurance, you are required to choose a deductible, which is the amount you are willing to pay, against the losses incurred. This amount determines the annual premium you will pay for your car insurance. Higher the deductible, lower the premiums.

The insurance company pays a part of the losses, while the deductible amount chosen by you will be paid by you. For example, if the total expenses you have to bear to get your car repaired after an accident are

INR 20,000/-. Your chosen deductible is INR 5,000/-, then the insurance company will pay INR 15,000/- and you will pay INR 5,000/- from your pocket.

While buying a car policy, choosing a deductible is an

important step as you pay the deductible for each and every situation in which you require your insurance company to cover damages.

If you face a grievous situation with your car, simply claim for car insurance and you will be reimbursed as per the eligibility mentioned and add-ons attached with your type of policy.

You need not go anywhere!

Buy your car policy online at darshadvisory.com after comparing all the policies and add-ons at just few clicks!

Eligibility, Documents And Process To Buy Online Car Insurance

At darshadvisory.com, we provide you a comprehensive platform which provides answers to all your car insurance related questions and helps you to compare and choose the best car policy.

You simply have to fill in the required details such as your name, contact details, car model and make, car registration number, your city and you will get an access to all possible options on car insurance policies to choose from.

- Your current policy document, in case of renewal or switch

- Your driving license copy

- Your vehicle registration documents with the copy of RC (Registration Certificate)

- Your address proof

- A voided check in case you want to set up EFT (Electronic Funds Transfer) for premium payment.

Key Advantages And Features

darshadvisory can guide you to the best suited car insurance for you, through its effective comparison tools and exact data driven statistics. Before you buy, you must know the key benefits and features of a online car insurance:

Exclusions: What Is Not Covered In A Car Insurance?

Your car insurance policy covers you against financial losses that you may incur during an accident or theft. However, there are certain events, which your policy may not cover!

When you search for the best

car insurance quote at darshadvisory.com, it is important to understand how your policy works, so that you are better prepared in the unfortunate event of a claim!

Here are a few conditions which are not covered by a car insurance policy:

- Occurrence of loss or damage when the policy has expired or not active.

- Normal wear and tear of the car and its parts.

- Usual depreciation on the car.

- When the person driving does not possess a valid driving license.

- Electrical or mechanical breakdown.

- If the person is found to be driving under the influence of liquor/alcohol/drugs.

- Loss or damage as a result of war /mutiny /nuclear risks.

- Damage to engine due to oil leakage.

- If the car faces a mishap while being driven outside India.

- If the car is used for any other purpose other than its intended use.

For any queries, please do write to us, or get in touch with us through our 9:00 am to 7:00 pm chat assistance.

Add-on Covers With Your Car Insurance!

Add-on is an additional benefit added to your car policy which covers your car against unforeseen expenses. You can buy add-ons, also known as riders, by paying extra premium.

There are various types of add-ons

offered by insurance companies, but you should select the one according to your specific requirements.

Accidental Cover

This add-on is applicable on the owner(if he is driving the car) as well as the paid driver. With this add-on in place, the insurance company will pay a lump sum amount as a compensation to the driver, if they die or suffer a serious injury in a car accident. This is one of the most important add-ons to have on your car policy.

Zero Depreciation

After an accident, some of the car parts need to be changed. Depending on how old the car is, the insurer will pay as per the depreciated value of those spare parts. If you have zero depreciation cover attached to your policy, you get the insurance claim as per the actual value of spare parts, which helps you save a lot of money on car repair.

Engine Cover

Engine is the most important part of your car and it is likely to get damaged by incidents like flooding. As your policy does not covers damage caused due to flooding, engine cover add-on helps you to bear the engine repair or replacement expenses through your car insurance policy.

Assistance on Road

This add-on cover ensures that the insurance company arranges for your car to be towed away to a garage and get you help to reach your destination, in case your car gets broken in a secluded place.

Daily Allowance

If your car is at a garage for repairs, this cover helps you with cash to arrange for an alternative mode of transport till you get your car back. It is normally given for a period of 10-15 days and ranges from Rs. 500-Rs. 1000 depending on the model of the car.

Lock And Key Replacement Benefit

If you lose your key and require getting a new key and lock, this add-on can help you get the actual cost of it rather than just a limited amount that insurance companies normally offer.

Consumables Cover

If your car is not older than three years, you can buy this add-on to claim for any money spent on nuts & bolts, screen washers, engine oil, bearings and other consumable parts, when your car meets with an accident. This is usually not covered in a car policy. All of the above add-ons are optional but they are very useful in certain situations. Keeping in view your actual requirements, you may opt for some or all of them.

Return to Invoice Cover

Usually your car is valued as per the Insured Declared Value (IDV) or current market value, which is lower than the actual value of the car. If your car gets totally damaged in an accident or gets stolen, the insurance company will pay you the claim as per IDV. But with this add-on in your policy, you can get the actual value of your car without deducting the registration charges, road tax and any depreciation calculated on it.

No Claim Bonus (NCB) Cover

If you do not file for any insurance claim throughout the year of your car insurance policy, you get to enjoy no claim bonus. This comes in form of discounts on premiums for your next policies. For example, you get 20% discount on the premium you pay for your next policy after a claim free year. This can go up to 50% if you do not claim an insurance for 5 continuous years. In case, you are required to file even a single claim in an unforeseen event, your NCB will become zero. But, with NCB cover in your policy, you can keep your bonus intact and claim insurance.

Importance of Buying Online Car Insurance

If you are driving a car on the roads, you definitely need a car insurance! It is very important to remain insured, safe and secure under an adequate car insurance policy. This helps you to save on money and a lot of mental stress.

Here is why it is very important to have a car insurance:

To Cover Accidental Damages

You can encounter an accident anytime, no matter how careful a driver you are. The damages that you incur during accidents bring down a whole lot of expenses.

A comprehensive car insurance policy helps to cover all the expenses for all damages to your car, or to another car in collision.

To Remain Covered For Medical Bills

In case of an accident, cost is to be incurred for injuries, loss of life or limb. A third party car insurance helps to bear the expenses for damages

to the other driver’s vehicle as well as provide money for any loss of life or limb along with hospitalization and legal expenses.

Natural Calamities

You can drive with utmost safety and never meet an accident. But, if the car is damaged due to a flood, fire or earthquake, there is little you can do about it. It

is better to have a comprehensive car insurance policy to have such damages reimbursed.

Theft and Vandalism

With increasing crime rates you need to be safe and secure. Comprehensive car insurance provides you cover for instances involving theft and physical damages due

to vandalism. If your car is insured, you get the value and are saved from great losses.

To Fulfill Legal Requirements

As per the Indian Motors Vehicle Act, third party insurance is mandatory on all the vehicles. Not adhering to this law can result in fines and penalties.

Here is a clear comparison table to help you understand your insurance needs:

| THIRD PARTY COVERAGE | COLLISION COVER | COMPREHENSIVE POLICY | |

|---|---|---|---|

| Damage To Third Party's Vehicle | Yes | No | Yes |

| Damage to Own Car | No | Yes | Yes |

| Low Premium | Yes | Yes | No |

| Coverage Other Than Collisions | No | No | Yes |

| Personal Accident Cover | No | Yes | Yes |

| Coverage of Loss of Belongings in The Car | No | No | Yes |

| Medical Expenses For Self | No | No | Yes |

| Medical Expenses For Third Party | Yes | No | Yes |

| Loss Due To Natural Calamities | No | No | Yes |

| Car Theft | No | No | Yes |

It is very important to get your car insured at the earliest. If you already have coverage, get it renewed on time. Whether you go for a cheap car insurance policy like the third party insurance or a bit expensive one like comprehensive car policy, what matters is that your car is insured against all kinds of unforeseen risks.

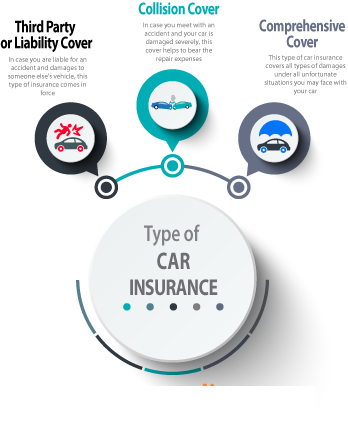

Types of Online Car Insurance Policies

Car Insurance in India comes in three major forms. Here is a quick list of all types of car insurance available with insurance providers:

Third Party or Liability Cover

In case you are liable for an accident and damages to someone else's vehicle, this type of insurance comes in force. It is mandatory by law to have a third party insurance cover, before you start driving on roads. Liability insurance will cover the cost of repairs for any third party property damaged by an accident as well as the medical bills for the other person from resulting injuries. This cover is mandatory for all cars.

Collision Cover

In case you meet with an accident and your car is damaged severely, this cover helps to bear the repair expenses. Also, if the damages are such that the repair expenses are exceeding the total value of the car, the collision cover pays the value of the car. This cover is important for expensive high-end cars.

Comprehensive Cover

This type of car insurance covers all types of damages under all unfortunate situations you may face with your car. It covers accidental damages, medical expenses to self and others and also, damages due to weather, natural calamities, car theft, and vandalism, which are not covered in other two insurances, are covered in comprehensive cover. It is not compulsory by law to have comprehensive coverage, but if it suits your budget, it is one of the most important insurance policies to have in your kitty if you are a regular driver. It can further be enhances by adding on the riders like NCB (No Claim Bonus), accessories cover, invoice cover etc. With the all-inclusive features that this cover comes with, it is expensive than the rest two.

Tips To Buy Online Car Insurance Policy

darshadvisory, your best insurance advisor, is here to share some important tips to buy car insurance. Please make sure to consider these points while making your search.

Choosing The Insurance

There are two types of car insurance in India:

Third Party Liability Insurance- This is a compulsory plan for all vehicle owners and it covers damage to property, accidental death and injury to a third party to the contract. The

first two parties are the insured and the insurance provider.

Comprehensive Plan This plan covers damage to own vehicle as well as the third party obligations. It also covers theft and damages caused by events like fire, earthquake, cyclones, floods

etc.

Go for a comprehensive plan as you remain safe and secure from all sides, in an unfortunate event

How To Reach Best Premium

Based on Vehicle - Get your car inspected before you choose a policy. Depending on the age, brand, make, model and fuel of your car, compare car insurance online plans and go for the one which offers all inclusive plan in a lower premium.

Based on Claims History - Claimless policies lead to no claim bonus the following year which means you pay a lower premium. Make sure you do not claim petty amounts for small accidental repair.

Based on Driver- Keep your car a single user drive. A vehicle driven by multiple people attracts higher premiums.

How To Reduce Premium?

If you choose a higher deductible (amount to be paid from your own pocket in case of accidental repairs), the premium goes down.

If your car has in-built security features, approved by Automotive Research

Association of India (ARAI), you enjoy further discounts on premium.

Not filing for claims consecutively for 3-4 years can lead to a no claim bonus of as much as 40-50% lesser premium in the fifth

year!

Precautions - Do not make these mistakes while buying car insurance

Declaring reduced value of the car in the insurance form may reduce the premium initially, but in case of an accident or theft, this proves real costly, as the insurance provider will settle the claims as

per IDV (insured declared value), only. Hence, always try to provide the right value of the car to gain maximum claim benefits.

Never forget to renew your policy in time. You get a grace period

of a week from policy expiry date. Post that, you lose discounts and other lowered premium benefits!

Get Discounts On Your Online Car Insurance Policy

Save Money, Buy Smart!

Here is a range of smart discounts on your car insurance policy for you to save money and buy smart!

While you can't do much about the rise in fuel prices or vehicle buying costs, you surely

can make a few smart decisions to ensure that you pay a discounted price on your car insurance!

Age Discount

If you are aged between 35 to 45 years, you are eligible to enjoy a discount of 5% on the OD premium. This discount further increases to 10%, if you belong to the age bracket of 46 to 60 years.

Anti-Theft Discount

When you install an ARAI approved anti-theft device in your car, your insurer gives you a reward by providing you with a 2.5% discount on the Own Damage (OD) premium.

No Claim Bonus

For every claim free year, you are entitled to receive a discount, which may start at 20% and increase steadily to a whopping 50% of the renewal premium amount. What’s more, this NCB is transferable, every time you buy a new car or switch to a new insurer.

Professional Discount

Are you a practicing chartered accountant, doctor, defense personnel, a teacher in a Government recognized institution, or an employee of the State/Central Government? If yes, then you are up for an additional discount on the OD premium!

AAI Discount

In addition to NCB, there are additional discounts available under Own Damage Premium for membership of Automobile Association of India.

If you are a member of an automobile association such as Automobile Association of India (AAI) or Western India Automobile Association (WIAA), the insurance company will offer you a discount in premium.

Voluntary Excess Discount

Voluntary Excess or a deductible is the minimum amount you declare to pay in the event of a claim. The higher the voluntary excess, the lower will be your premium! Now, when you are looking for a car insurance quote at darshadvisory.com, don’t miss out to mention these details! A little forethought can go a long way to get you extra discounts!

Expert Tips On Cutting Down Your Car Insurance Cost!

Looking for some expert tips for cutting your car insurance costs? Hunt no further, darshadvisory is your best advisor on everything related to insurance:

While making an online deal, since, you are buying directly from the insurance company, any distributor's margin or commissions thereof, are completely eliminated.

One more secret is, when entire policy selling and buying process is carried online, which cuts down the cost substantially, the insurance company shares the savings with the customers in the form of lower premiums.

As per law, your vehicle must be insured if it is being driven on the roads. If it is not insured, you are entitled to get penalized by the road traffic authorities. Therefore, car insurance online renewal in time are must which help you to cut your insurance cost too. Here's how:

If the policy has lapsed for a considerable period of time due to non-renewal then you may be required to buy a new car insurance policy in order to comply with the law which can cost you much higher than the previous one. Renew before the previous one expires and save your money.

Save on the fine and late fee which will be based on the lapse time between the policies. In the time lapse, when your car is running on the roads without an insurance, you are attracting a lot of risk. Moreover, if you encounter an accident or a car theft in that period, you will have to bear all the expenses on your own. With these handy cost cutting tips, it is time to compare car insurance online policy form darshadvisory.com NOW!

Factors That Affect Your Car Insurance Premium

Here are some important factors that affect your car insurance premium:

Age and Gender

If you are in the age group of 18-25 years, you will have to pay a higher premium as this is an accident prone age group, as per the insurance statistics.

Anti-theft Safety Discount

If your car is fitted with an ARAI (Automotive Research Association of India) approved anti-theft device, you enjoy an additional discount of 2.5%.

Fuel Type You Use for Your Car

If you drive petrol car, you pay lower premium, if you drive a CNG, your insurance comes at higher premium, because the chances of unforeseen damage are higher.

Car Model and Variant

If you own a high priced or high end car model, such as Bentley, Audi or BMW, you will pay a much higher premium. Simply because the theft rates for such vehicles are higher, the value of the vehicle is much higher and the damage cost is also quite costly.

No Claim Bonus (NCB)

If you did not make any claims throughout your insured year, you automatically get entitled to NCB which varies from 10% to 50% discount on premium, depending upon number of claim-less years. You can even transfer your NCB to another policy.

Township For Which The Insurance is Required

If you live in a posh colony or an active township, you pay higher premium. In urban areas where chances of accidents are higher than scarcely populated areas, the vehicle insurance is provided at a fairly high premium.

Car Make/Year of Manufacture/IDV

Older car, lesser premium, new car higher premium you pay. It is very simple. The year of manufacture directly effects the IDV (Insured Declared Value) of your car. The older is the car, lesser is IDV which is calculated as per the current market value of the car. The lesser is the IDV, lesser goes the premium.

Additional Discounts Based On Profession

If you belong to the category of defense personnel, doctors, government employees, or police force, you are entitled to get an additional discount on the premium, by default, as per all the insurance companies regulations.

At darshadvisory, you can key in all the factors and reach the best premium value as per your needs, in just a few clicks!

How darshadvisory Helps To Reach The Best Car Insurance!

A car insurance is must if you are driving on Indian roads. darshadvisory is a comprehensive platform where you can gather all information and buy the best car policy without any hassle. Simply because with us, buying a car policy is:

1. Easy 2. Affordable 3. Trustworthy

- Customized quotes matching with your exact requirements, resulting in huge savings on your car policy.

- Compare car insurance online, to filter your requirements through our rapid, accurate and reliable algorithms.

- Best and affordable quotes after comparing the premiums with various insurance providers across the plethora.

- The best car insurance policy, which will come across so perfect, that you will never have to worry.

At darshadvisory.com you are also benefitted with expert advice and hands on assistance based on your key needs.

We provide you:

- Informed, unbiased, and clear results to help you choose the car policy best suited to your vehicle.

- The help to go through the car policy purchase process, so that you sail smoothly and land at the best insurance plan.

- Instant policy in your mailbox, without going through long overtaxing process of filing forms.

- Quick, easy and reliable online payment methods to save time and effort.

All this is absolutely FREE of Charge and involves no paper-work at all!

From changes in your existing policy to the tricky questions you are too scared to ask, we have a quick, easy and friendly solution to all.

Here's a quick run through of the insurance bounties being offered at darshadvisory, for quick and easy car policy purchase.

- 1) Simple Hassle-free Process

- 2) Quick And Easy Purchase & Renewals

- 3) Claims Assistance At All Times

- 4) Short and Simple Forms To Be Filled

- 5) Nationwide Documents Pick Up Facility

- 6) Live Policy Tracking Resource

- 7) Advanced Feature Filters for Customized Needs

We are more than glad to tend to any queries you may have. Call us or write to us!

Car Insurance Online Renewal Process

Car Insurance Renewal is one of the most important, thoughtful and responsible steps to take, in order to keep your car safe and your expenses in check. In case your car insurance policy has expired or about to expire, it is very easy to get it renewed at your insurer's website or at darshadvisory.com. Always remember that switching to another insurer or renewing your policy with the same insurer, both will be hassle-free and easy processes if you do it before your policy expires or within the grace period.

What is Grace Period?

Some insurance providers offer grace period which allows you a time of 3 to 30 days after the your policy expired, to get it renewed without a lot of additional cost.Â

Do not overuse it or take undue advantage of it. Use it only when you absolutely need it. Some insurers may levy a late fee for using the grace period. The point to remember is that not all companies offer a

grace period. You must make sure at the time of buying the policy, whether you are entitled to grace period or not. If you have missed the renewal before expiry or within the grace period, you can still get

it renewed, but with a little more effort and a little more money.

Let us go through the important steps of car insurance online renewal:

- Get in touch with your insurance provider and ask them for the documents for policy renewal. The agent will visit you and help you to file a renewal without much of paper-work

- Alternatively, visit the insurance provider's website and go for online renewal, saving a lot of time, efforts and additional costs.

- Furnish the information required by the insurance provider.

- Choose the add-ons or benefits you want with your renewed policy.

- Make payment through crossed cheque or online transfer and be the owner of a valid car insurance policy.

- Find out the late fee of renewing the policy in grace period and pay.

- Make sure you have all the dues and pending premiums paid.

- Choose the policy you want to go for, after checking thoroughly for any changes or add-ons you may need in renewed policy.

- Furnish the required information by the insurance provider and gather your renewed policy after making due payments online or through a cheque to the insurance agent.

Here are the adversities of not renewing your policy within time:

- Higher Premiums

- Loss of Previous Benefits

- Fines Levied

- Fresh Inspection of The Vehicle

- Loss of NCB (No Claim Bonus)

- Lot of Legal Trouble With Police And Authorities Driving Without Insurance

- Huge Expenses In Case You Meet An Accident Without An Insurance Policy

Details To Be Furnished For Car Insurance Policy Renewal:

- Your Name (As on official documents)

- Your Contact Number and E-mail id

- Your Vehicle Registration Number And Copy of The RC

- The Existing Insurance Policy Number

How To Claim Your Car Insurance!

Here we bring you a few imperative pointers on how to claim your car insurance, in any of the following scenarios.

When Your Car Meets An Accident!

Keep the copies of your insurance paperwork up to date and intact. These are the most important instruments that can get you your claim.

After an accidental damage, immediately take pictures of the damage done. It should be done in both the cases, if the accident was your mistake, or someone else caused the damage.

Call for the cops. It is of utmost importance to activate the legal process immediately which will help immensely at the time of filing for claims. Let the cops inspect the vehicle and take note of the involved people and vehicles.

If it is possible, if the other party has not run away, record the details of the other vehicle including the model number, vehicle number, make of the car and more of such details. These details will be required to file and get the claim smoothly.

File an FIR which is very important for the claim process. Filing FIR is mandatory in the third party liability claim and without it, to make a claim will be very difficult for you.

Make a call to the representative of the insurance company you have been dealing with, at the earliest.

Take guidance from the representative on how to proceed and what forms or documents will be required to support your claim.

Your insurance company will require a "proof of damage" form as well as records relating to your claim (such as medical bills, car repair bills and a copy of the FIR). They may or may not be covered in your policy depending upon the type of policy and riders.

Present all the correct and validated information to the representative which is the right thing to do for claiming the insurance.

Inspection officials will be sent by your insurance provider to inspect and evaluate. This will include inspection and verification of the damage to the car, examining the evidence of any injury claims, and an initial payment.

In Case of A Car Theft

Lodge an FIR with local police station immediately without wasting any time.

Call the insurance provider office and inform the theft.

Call the RTO (Road Transport Office) and inform the theft.

Fill the claim form offered by the insurance company, providing the information such as policy number, vehicle registration number, RC number, date time and little description of the incident where the theft took place

Submit the following to your insurance provider

- The Duly Signed Claim Form

- The Original Copy of the FIR

- Copy of The Policy Documents

- A Copy of The Driving License

- The Original Keys of The Car

- Copy of the letter addressed to the RTO intimating theft

- Copy of The Vehicle’s RC

- RTO Transfer Papers Duly Signed Along With The Necessary Forms (Form 28, 29, 30 And 35).

Once the local police station submits the final no-trace which means the vehicle could not be found and the claim is approved, you must transfer the RC of the stolen car in favour of the insurance company, hand over all sets of keys and issue a letter of subrogation to the insurance company. Although filing a car insurance claim is fairly straight forward, it is important to do it properly or else the claim can become null and void.